3 Good Reasons To Remortgage Now

Homeowners have been feeling the impact of the coronavirus pandemic. Despite the government’s COVID-19 income support schemes, working households saw total income decline by an average 10% from February to May 2020.

And with employer support schemes due to come to an end, and a recession on the horizon, some households will be finding themselves even harder-stretched.

For many, remortgaging has been the solution.

A new survey by NatWest bank looks at the benefits homeowners have experienced, with 75% saying it’s had a positive impact on their daily life, and 23% saying their mental health has improved significantly with the easing of financial worries.

How does remortgaging work?

Remortgaging is the process of changing your mortgage deal with your current lender, or moving your mortgage to a new lender. It’s often done to avoid defaulting onto your current lender’s Standard Variable Rate (SVR) when your current fixed-rate period comes to an end.

But mortgage holders who’ve owned their property for some time, or who have done substantial home improvements, can remortgage to take advantage of an increase in property value.

If you originally took out your home loan with a 5-10% deposit, you will have been paying a higher interest rate because your higher loan-to-value (LTV) made you a greater risk for your lender.

But if your home is now worth substantially more, or over the last 10 years or so you’ve paid off a chunk of the capital, you’re now in a position to renegotiate more favourable terms.

So, what are homeowners deciding to do with their remortgage finance?

According to NatWest’s recent research, carried out in late May 2020, the top reasons why homeowners refinanced during lockdown were:

1 Accessing a lower interest rate which will reduce monthly payments

- The NatWest study shows 80% are taking advantage of that.

2 Releasing equity to fund home-improvements, particularly if postponing a house move

- 44% are postponing a house sale due to COVID19

- A third say they’re using funds for home improvements

3 Using a lump sum to relieve repay some accumulated debt or relieve financial anxiety on their household

- 10% say they want to release equity

- 26% refer to wanting to relieve some kind of financial pressure

Refinancing from necessity or choice?

Government support for employees on furlough was capped at £2,500 a month: the equivalent of a net income of £30,000 a year.

Homeowners who were earning, say, £50,000 a year or more, and took out large mortgages which their salaries were then able to support, have found themselves squeezed by the cap on supported earnings.

Of the homeowners surveyed by NatWest, who did manage to remortgage based on their lockdown income:

- more than three-quarters (76%) did it by choice rather than necessity

Why are homeowners looking for mortgage refinance now?

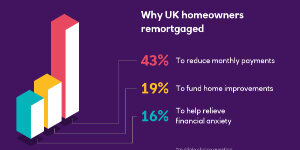

(Participants in the survey were able to pick more than one answer for this:)

- Reduce monthly payments (43%)

- Fund home improvements (19%)

- To relieve financial anxieties on my household (16%)

- To increase income due to a sudden change in life circumstances (12%)

- To support dependents (11%)

- Release equity (10%)

- Relieve financial anxieties caused by COVID (8%)

- To buy a second home (7%)

- To fund/start a business (5%)

Look at your remortgage options

Tags