How To Buy Shares

How to buy shares

How to buy shares

- 0% Commission

- Copy top Investors

- Free access to TipRanks expert share analysis

How to buy shares

6 Steps to buy shares using selected trading apps.

Top trading apps

-

Best for Share Dealing

- Award Winning Trading App

-

Best For Active Traders

- Trade 18,000+ markets

-

Best for flat fee trading

- Join today & get £50 FREE trading credit

The right share trading app or platform for you will depend on your requirements.

How do you buy shares using a trading app

Our view: The next generation of online trading platform apps means you can get setup & buy UK shares in as little as 5 minutes!

- Select a share trading app - See our top platform picks

- Open your share account - To do this you will need your bank details and national insurance number

- Fund your account - You will need to fund your a/c with a debit or credit card or bank transfer

- Search for the share using the UK stock code - Type in the stock code into the search box

- Check out the latest info and price for the selected share - Some platforms offer free research and analysis

- Buy the share - Nice and easy!

Share Trading Platforms & Apps

| Trading Platforms: | Features:* | Go To Site: |

| DEGIRO are one of largest and cheapest brokers in Europe. Access to over 50 markets in 30 countries. Low commissions/fees. User-friendly, simple platform. Investing involves risk of loss. | See Deal » |

| AJ Bell offers overseas trading in 24 international markets. Capital at risk. | See Deal » |

| Interactive Investor are the UK's #1 flat fee platform. Over 350,000 customers. Capital at risk. | See Deal » |

| IG Trade & invest with the world's leading online trading provider.** Trade over 17,000 markets with spread bets and CFDs and invest in thousands of global shares & ETFs. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Capital at risk. | See Deal » |

| Fineco Bank has One of Europe’s largest banks, listed and part of Euro Stoxx 600. 1.3 million clients. Don’t pay for things you don’t have to. £0.00 account monthly fee, no custody fees, no minimum deposit, no inactivity charges. Capital at risk. | See Deal » |

| SAXO Access over 30,000+ stocks across 60+ exchanges worldwide. Ultra competitive pricing. Benefit from extensive charting with 50+ technical indicators, integrated Trade Signals and innovative risk management tools. Investing involves risk of loss. | See Deal » |

| Hargreaves Lansdown The UK's #1 broker. Price improvement service helps you get the best price for your shares. Capital at risk. | See Deal » |

*Please note that additional fees may be applied by platform/App providers for their services. ** No 1 For CFDs and spread betting, based on revenue excluding FX (published financial statements, October 2021).

Why use a trading platform app to buy shares?

You don’t have to buy and sell shares using a shares app to manage your investments.

You could go down the old-school route using a stockbroker directly to buy and sell investments.

This can involve lots of paperwork and waiting for the postman to send you paper statements which for some people may be perfectly adequate.

Your preference may be to deal with a real person to make things happen – whilst this can work, it can be slow, cumbersome, and potentially more expensive.

The good news is that with technological advances, investors now have a significant choice when buying UK and international shares.

Benefits of using a share trading platform app include:

- Lower trading costs

- Easy access to the UK and international stock markets

- 24/7 access to your investments

- You can hold all your tax-efficient investments, such as ISAs and SIPPs, in one place: including lifetime ISAs, the right to buy ISAs and Junior ISAs

- Plus, any other fund holdings or shares that you’re trading outside of a tax-free environment from a general trading account

How do you pick a trading platform app?

Share trading platform services offered vary widely, and so do the costs.

5 things to consider:

1. Do you want to trade only shares?

Not all investment platforms allow you to trade shares on all markets.

If your focus is on UK shares, there is an extensive choice of options.

If you want to invest further afield, you must ensure the platform you choose is right for you.

2. Do you want to do a lot of share trading?

Active investors will want to look for a trading app that offers the lowest fees for volume trades.

If you are going to trade stocks and shares regularly, most trading platforms will offer lower trading prices based on volume.

Some trading app providers, such as eToro do not charge when you trade, but there may be fees incurred if you do not trade within 12 months.

3. Not all trading platforms offer mobile trading apps?

Before you sign up with a platform check, they offer a trading app.

eToro Share Trading App

Discover eToro’s intuitive and innovative trading app:

Trade and invest any time, anywhere, and easily alternate between your laptop, tablet or mobile device.

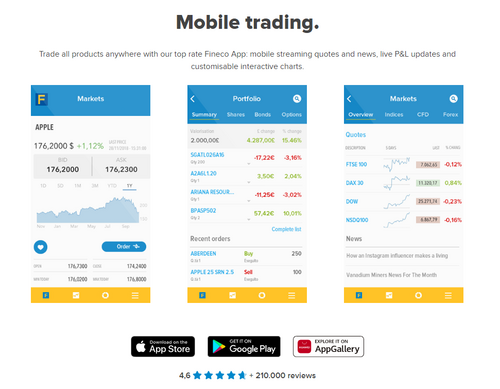

Fineco Bank ShareTrading App

Trade all products anywhere with the Fineco App:

mobile streaming quotes and news, live P&L updates and customisable interactive charts.

Hargreaves Lansdown Trading App

Trading on the go

Trade UK shares, bonds and funds, and overseas shares from Europe, the US and Canada.

4. How easy is this share trading app to use & what kind of features does it offer?

How easy is the app to use to buy and sell UK shares?

App platform functionality is becoming the key battleground in persuading traders which platform to select.

Trading on the move is key in offering traders alerts and buy/sell signals at key trading times. A good app trading app will offer the full range of ‘at best’, ‘stop loss’ or ‘limit’ orders.

Good research tools and the latest news feeds to help decision-making are high up on traders’ wish lists when selecting a good trading platform.

Many investors are prepared to pay a bit more in fees for platforms that offer an easy interface that makes for a great trading experience.

5. Share trading apps for beginners

Some trading app platforms, such as eToro offer customers the option of copying the trades of successful traders.

This can be an attractive option for new share traders where you don’t have to decide when to buy or sell. eToro also provides a demo account to practice share trading in a non-live environment.

IMPORTANT:

No news, feature article or comment should be seen as a personal recommendation to invest. Before deciding to invest, you should ensure that you are familiar with the risks associated with a particular plan. If you are unsure of the suitability of a specific product, both in respect of its objectives and risk profile, you should seek independent financial advice.

The value of shares, ETFs and ETCs bought through a share dealing account, stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 67%-81% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Tax treatment of ISAs depends on your individual circumstances and is based on current law which may be subject to change in the future. ISA transfer charges may apply, please check with your provider.