MoneyFarm Review

MoneyFarm Review: Is the Investment Platform Right for You?

MoneyFarm is a digital wealth management platform – it offers personalised investment strategies, a range of account options, and competitive fees to help you achieve your financial goals. In this review, we’ll dive into MoneyFarm’s platform and uncover how they stack up against other robo-advisors in the market.

Key Takeaways

- MoneyFarm offers tailored investment solutions with low fees and customisable portfolios to suit your individual needs.

- With competitive returns, strong historical performance, and robust data security measures, MoneyFarm can be a great choice for investors seeking long-term growth.

- Customers generally praise the platform’s ease of use & customer service.

Understanding MoneyFarm

MoneyFarm is a digital wealth management company that aims to ‘democratise’ investing by providing a variety of account options, portfolio types, and competitive fees.

With a focus on making investing accessible to everyone, MoneyFarm combines its investment philosophy with advanced technology to help you make the most of your money.

Whether you’re a seasoned investor or just starting out, MoneyFarm offers a range of investment accounts, including:

- Stocks & Shares ISA

- General Investment Account

- SIPP

- Junior ISA

These platforms cater to your personal financial goals and risk tolerance.

Company Background

Founded in 2011, MoneyFarm has quickly grown to over £3.5bn in assets under management for more than 130,000 investors, with a mission to make personal investing more efficient and accessible through technology.

Their dedication to providing cost-effective and personalised investment solutions has earned the company awards such as the UK’s “Best Online Direct to Consumer Investment Platform” and “Innovation of the Year.”

Investment Philosophy

At the core of MoneyFarm’s approach is an investment philosophy that combines passive investment strategies with active management.

Their data-driven approach, backed by human expertise, aligns with your investment goals and risk tolerance. By using a mix of exchange-traded funds (ETFs) in their portfolios, MoneyFarm aims to provide a tailored investment experience that optimises your investment journey while trying to keep the costs as low as possible.

Whether you’re interested in fixed allocation portfolios, actively managed portfolios, or socially responsible portfolios, MoneyFarm has a solution that suits your needs.

Account Options and Features

MoneyFarm offers a range of account options to cater to different investment needs and goals. They include:

- Tax-efficient Stocks & Shares ISAs

- Flexible General Investment Accounts

- Retirement-focused SIPPs

- Junior ISA for tax-free savings for your child’s future

We’ll now examine each of these account options along with their features.

Stocks & Shares ISA

The MoneyFarm Stocks and Shares ISA has the following features:

- Tax-free returns – invest up to £20,000 annually

- Easy transfers, free if moving an ISA to MoneyFarm from elsewhere.

- Minimum investment of £500

- Invest in a range of portfolios tailored to your risk appetite and investment goals

- Transparent pricing

- Projection tools

General Investment Account

The General Investment Account (GIA) from MoneyFarm offers:

- No investment limit

- The ability to customise your portfolio

- Expert management and planning advice

- Low fees, decreasing as you save and invest more

- Easy access to your funds

The GIA is an excellent choice for those looking to actively manage their investments or seek investment advice from investment consultants. Note that the minimum investment for a MoneyFarm General Investment Account is £500, which may be a barrier to some.

SIPP

MoneyFarm’s Self-Invested Personal Pension (SIPP) is a pension platform that focuses on adaptive portfolio management.

By adjusting your portfolio as you approach retirement, MoneyFarm’s SIPP acts as an investment advisor, reducing the risk of your portfolio gradually while providing 25% tax-free withdrawals at retirement (with the remainder taxed as income).

As you reach age 55, you have the option to withdraw up to 25% of your pension tax-free. Additionally, your pension funds can be passed on to your beneficiaries free of inheritance tax if you die before 75.

Transferring your pension to MoneyFarm’s SIPP typically takes between 3-4 weeks.

Junior ISA

MoneyFarm’s Junior Individual Savings Account (JISA) is an excellent way to invest in your child’s future. With tax-free savings and efficient investment options, the Junior ISA allows you to build a nest egg for your child’s future expenses, such as education or a first home.

The annual deposit limit is set at £9,000, and monthly deposits can be automated.

For example, if you deposit £75 per month, by the time your child is 18 the account would be projected to hold over £28,000.

Portfolio Types and Management

MoneyFarm offers a variety of portfolio types to cater to different risk levels and investment preferences. They include:

- Actively managed portfolios that adjust to market and economic conditions

- Fixed allocation portfolios that focus on long-term growth, with minimal effort and upkeep

- Socially responsible portfolios for those looking to invest in companies with strong ESG performance

- Thematic investing options that focus on long-term global trends

Actively Managed Portfolios

Actively managed portfolios from MoneyFarm offer the following benefits:

- Tailored to your individual risk profile

- Adjusted based on market conditions

- Potential for higher returns.

- Utilise a combination of ETFs and expert portfolio management

- Aims to maximise investment returns while minimising risk

Fixed Allocation Portfolios

Fixed allocation portfolios offer a passive investment strategy that focuses on long-term growth with lower fees.

By creating specific asset allocations for each fixed allocation portfolio, MoneyFarm’s fixed allocation portfolios provide a hands-off investment option that suits those looking for a low-cost, low-intervention strategy.

A hands-free approach is suitable if you’d rather not have to think about your finances, and let them quietly appreciate out of sight.

Socially Responsible Portfolios

A socially responsible portfolio from MoneyFarm invests in companies with strong ESG (Environmental, Social, and Governance) performance, aligning your investments with your values.

By focusing on companies that prioritise sustainability, ethical practices, and good governance, MoneyFarm’s socially responsible portfolios allow investors to make a positive impact while still aiming for strong returns.

Thematic Investing

Thematic investing from MoneyFarm allows investors to focus on long-term global trends and sectors, such as technology or green energy. By investing in sectors like e-commerce, artificial intelligence, and renewable energy, thematic investing provides an opportunity to benefit from the growth of these transformative trends while maintaining a balanced and risk-controlled portfolio.

Fees and Charges

MoneyFarm charges competitive fees for its services, including management fees, ETF fees, and market spread effects.

The fees vary depending on the size of your investment, making MoneyFarm more affordable for larger investments.

There are usually underlying fees charged by investment funds used by MoneyFarm, as with all unit trusts and OEICs. These depend on the specific fund, but usually range from 0.10-0.50%.

With a focus on providing cost-effective investment solutions, you can grow your wealth without incurring excessive fees.

Management Fees

Management fees for MoneyFarm’s services start at 0.75% for investments up to £100,000 and decrease as the investment grows.

For investments between £100,000 and £500,000, the management fee ranges from 0.60% to 0.45%. For investments above £500,000, the management fee ranges from 0.45% to 0.35%.

This sliding scale of fees makes MoneyFarm more affordable than some competitors, particularly for larger investments. However, it is generally more expensive than a ‘DIY’ platform in which you choose your entire portfolio yourself.

ETF Fees

ETF fees are an additional cost associated with investing in MoneyFarm’s portfolios. But generally, ETF fees are quite low compared to managed funds, averaging around 0.20%.

These fees contribute to the overall cost-effectiveness of the platform, allowing you to invest in a diverse range of assets without incurring high fees.

Transfer and Early Exit Fees

You may be charged when you move your portfolio to MoneyFarm from an external platform, and the fee is usually around £75.

If you withdraw your money within the first year, you may be charged an early-exit fee, typically about 0.50% of the withdrawn amount.

| Amount Invested | Actively Managed Fee | Fixed Allocation Fee | Average ETF Fee | Market Spread |

| £0-£10k | 0.75% | N/A | 0.20% | Up to 0.10% |

| £10k-£20k | 0.70% | N/A | 0.20% | Up to 0.10% |

| £20k-£50k | 0.65% | N/A | 0.20% | Up to 0.10% |

| £50k-£100k | 0.60% | N/A | 0.20% | Up to 0.10% |

| £100k-£250k | 0.45% | 0.45% | 0.20% | Up to 0.10% |

| £250k-£500k | 0.40% | 0.35% | 0.20% | Up to 0.10% |

| £500k + | 0.35% | 0.25% | 0.20% | Up to 0.10% |

For example, if you invested £80,000 into an actively managed fund, the fees would be 0.40%, in addition to the ETF fee of 0.20%, as well as the effects of market spread and underlying costs of the investment fund, so around 1%, or £800.

Performance and Returns

MoneyFarm’s historical performance and average returns show strong results, with some portfolios outperforming competitors and market benchmarks.

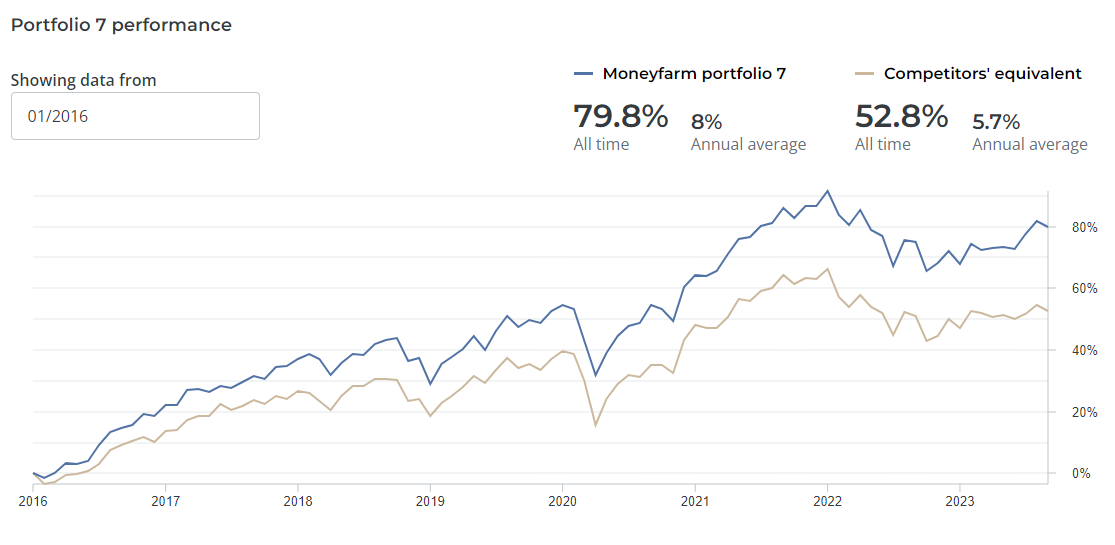

The graph below looks at the portfolio 7 performance.

This impressive track record demonstrates the potential for consistent returns across various risk levels and portfolio types, making MoneyFarm a compelling choice for investors seeking long-term growth.

Average Returns

Average returns for MoneyFarm’s portfolios vary depending on the portfolio and risk level, but generally show competitive results compared to other robo-advisors.

While past performance is not a guarantee of future results, MoneyFarm’s track record of delivering strong returns across different portfolio types and risk levels can provide confidence to investors seeking long-term growth and returns.

Security and Trustworthiness

MoneyFarm ensures security and trustworthiness by adhering to regulatory compliance, implementing robust data security measures, and protecting client assets.

By following all necessary regulations and prioritising the safety and security of your investments, MoneyFarm provides a reliable and trustworthy platform for your investment needs.

We’ll now investigate the specific measures MoneyFarm implements to guarantee the security and trustworthiness of its services.

Regulatory Compliance

MoneyFarm is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring that all legal, regulatory, and compliance matters are addressed.

This regulatory oversight provides peace of mind, knowing that your assets are in the hands of a responsible and trustworthy investment platform.

Data Security

Data security is a top priority for MoneyFarm, which implements several measures to protect client information and investments.

These measures include encryption, secure servers, and regular security audits to ensure the safety and security of your data and assets.

Customer Support and Resources

MoneyFarm also offers excellent customer support and educational resources to help you make informed investment decisions and stay updated on market trends and investment strategies.

With a range of support channels available, including phone, email, and live chat, you can receive assistance and guidance whenever you need it.

Additionally, they provide a wealth of educational resources to help you navigate the world of investing with confidence.

Support Channels

MoneyFarm’s support channels are available 24/7, providing assistance and guidance for investors.

You can reach out to their personal investment advisors via phone, email, or live chat for help with portfolio selection, performance, retirement planning, drawdown support, and pension consolidation.

With readily accessible support, you can confidently make investment decisions and manage your portfolio with the knowledge and expertise of MoneyFarm’s team at your disposal.

Educational Resources

MoneyFarm’s educational resources empower investors to make informed decisions and stay updated on market trends and investment strategies.

These include an FAQ section, blog, and video library resources.

Comparing MoneyFarm to Competitors

For a complete understanding of MoneyFarm’s offerings, a comparison with its competitors like Nutmeg, Wealthify and Lightyear is worth doing.

By examining the similarities and differences in fees, performance, and features, we can better understand the unique advantages and drawbacks of each platform.

We’ll now examine how MoneyFarm compares against these three competitors.

Nutmeg Comparison

When comparing MoneyFarm to Nutmeg, both platforms offer similar services, but there are some key differences. Here are the main points to consider:

- Nutmeg may have higher fees for investments over £10k

- MoneyFarm provides free investment consultant calls

- Both platforms have comparable performance and customer service

- MoneyFarm’s platform is said to be easier to use

Ultimately, the choice between MoneyFarm and Nutmeg will depend on your personal preferences and investment needs.

Betterment Comparison

Comparing MoneyFarm to Betterment, both platforms have similar pricing structures and customer service. However, there are some differences.

For example, MoneyFarm’s platform is known to be simpler and more user-friendly than Betterment’s. Their fee structure is also different, and so the cheapest option will depend on the specific type of portfolio you invest in and how much you have invested.

Wealthify Comparison

Wealthify is another competitor to MoneyFarm, offering a low startup fee of just £1, making investing accessible to everyone.

Wealthify’s platform is welcoming and user-friendly, allowing users to meet their team before investing. However, MoneyFarm’s performance and range of portfolio options may be more appealing for some investors.

The choice between MoneyFarm and Wealthify will depend on your individual investment goals and personal preferences.

MoneyFarm Customer Reviews

MoneyFarm’s customer reviews on Trustpilot show a rating of 3.9 out of 5 stars, with many users praising the platform’s ease of use, clear website, and good customer service. However, some users have expressed concerns about investment performance.

Customers cite the good communication of staff over the phone and other support networks, as well as the simplicity of the website, especially for beginners.

While individual experiences may vary, the overall positive feedback suggests that MoneyFarm is a reliable and user-friendly platform for managing your investments.

However, it’s important to remember that Trustpilot ratings are based on customer reviews and may not always be entirely accurate or reflect the most recent information about MoneyFarm’s services.

Summary

MoneyFarm offers a comprehensive and user-friendly platform for managing your investments with a range of account options, portfolio types, and competitive fees.

With a strong track record of performance, excellent customer support, and robust security measures, MoneyFarm makes investing accessible and straightforward.

Frequently Asked Questions

Can I trust Moneyfarm?

Moneyfarm has good performance and a low cost structure for investing, making it worth considering. It is also regulated by the Financial Conduct Authority (FCA), and utilises several data protection measures.

What happens if Moneyfarm goes bust?

If Moneyfarm were to go bust, your funds should be protected up to £85,000. The Financial Services Compensation Scheme provides this security for eligible money and investments.

Is Moneyfarm protected by FSCS?

Yes, Moneyfarm is protected by the Financial Services Compensation Scheme (FSCS) with coverage up to £85,000.

How does MoneyFarm’s fee structure compare to other robo-advisors?

MoneyFarm’s fees are generally more affordable than other robo-advisors, offering a sliding scale based on the size of your investment. MoneyFarm is also known for its great customer service, where investment divisions can be discussed either over the phone, using online chat or face to face.

Can I invest in socially responsible portfolios with MoneyFarm?

Yes, you can invest in socially responsible portfolios with MoneyFarm. They offer portfolios that invest in companies with strong ESG performance, so your investments are aligned with your values.

Tags