Best Trading Apps To Buy Shares

Looking for a share trading app to trade that ticks all your boxes?

The right trading app will depend on your requirements:

- How do you buy shares using a trading app?

- Why use a trading app to buy UK shares?

- How do you pick a trading app?

How do you buy shares using a trading app

Our view: The next generation of online trading platform apps means you can get setup & buy UK shares in as little as 5 minutes!

- Select a share trading app

- Open your share account – To do this you will need your bank details and national insurance number

- Fund your account – You will need to fund your a/c with a debit or credit card or bank transfer

- Search for the share using the UK stock code – Type in the stock code into the search box

- Check out the latest info and price for the selected share – Some platforms offer free research and analysis

- Buy the share – Nice and easy!

Why use a trading platform app to buy UK shares?

You don’t have to buy and sell UK shares using a shares app to manage your investments.

You could go down the old-school route using a stockbroker directly to buy and sell investments.

This can involve lots of paperwork and waiting for the postman to send you paper statements which for some people may be perfectly adequate.

Your preference may be to deal with a real person to make things happen – whilst this can work it can be slow and cumbersome and potentially more expensive.

The good news is that with advances in technology, investors now have a significant choice when buying UK and international shares.

Benefits of using a trading platform app include:

- Lower trading costs

- Easy access to the UK and international stockmarkets

- 24/7 access to your investments

- You can hold all your tax-efficient investments such as ISAs and SIPPs in one place: including lifetime ISAs, right to buy ISAs and junior ISAs

- Plus any other fund holdings or shares that you’re trading outside of a tax-free environment from a general trading account

How do you pick a trading platform app?

Trading platform services offered vary widely, and so do the costs.

5 things to consider:

1. Do you just want to trade UK shares?

Not all investment platforms allow you to trade shares on all markets.

If your focus is on UK shares then there is an extensive choice of options.

If you want to invest further afield then you need to ensure the platform you choose is right for you.

2. Do you want to do a lot of trading?

Active investors will want to look for a trading app that offers the lowest fees for volume trades.

If you are going to trade stocks and shares regularly, most trading platforms will offer lower trading prices based on volume.

3. Not all trading platforms offer mobile trading apps?

Before you sign up with a platform check they offer a trading app.

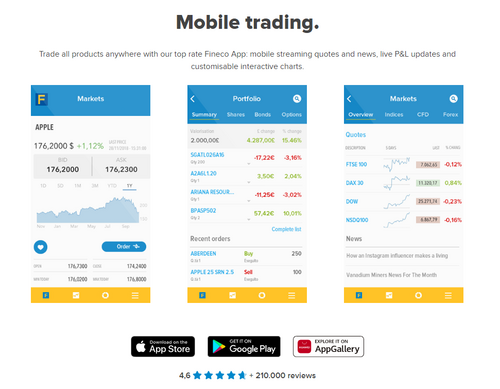

Fineco Bank Trading App

Trade all products anywhere with the Fineco App:

mobile streaming quotes and news, live P&L updates and customisable interactive charts.

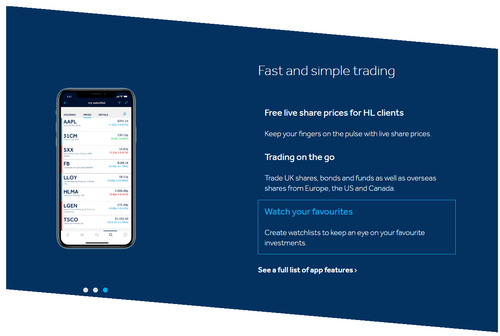

Hargreaves Lansdown Trading App

Trading on the go

Trade UK shares, bonds and funds as well as overseas shares from Europe, the US and Canada.

4. How easy is this trading app to use & what kind of features does it offer?

How easy is the app to use to buy and sell UK shares?

App platform functionality is becoming the key battleground in persuading traders which platform to select.

Trading on the move is key in offering traders alerts and buy/sell signals at key trading times. A good app trading app will offer the full range of ‘at best’, ‘stop loss’ or ‘limit’ orders.

Good research tools and latest news feeds to help decision making are high up on traders wish lists when selecting a good trading platform.

Many investors are prepared to pay a bit more in fees for a platforms that offer an easy interface that makes for a great trading experience.

5. Trading apps for beginners

Some trading app platforms offer customers the option of copying the trades of successful traders.

This can be an attractive option for new traders where you don’t have to decide when to buy or sell.

IMPORTANT:

No news, feature article or comment should be seen as a personal recommendation to invest. Prior to making any decision to invest, you should ensure that you are familiar with the risks associated with a particular plan. If you are at all unsure of the suitability of a particular product, both in respect of its objectives and its risk profile, you should seek independent financial advice.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 67%-75% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Tax treatment of ISAs depends on your individual circumstances and is based on current law which may be subject to change in the future. ISA transfer charges may apply, please check with your provider.

Tags